Long Term Care Deduction 2025. The irs has released new deduction amounts for 2025. This allows for the deduction of either the actual premium or the eligible premium paid on a tax.

Long Term Care Tax Deduction Ppt Presentation Summary Show Cpb, The just announced 2025 limits for an individual age 70 or more is $5,880, according to aaltci. Click here to view relevant act & rule.

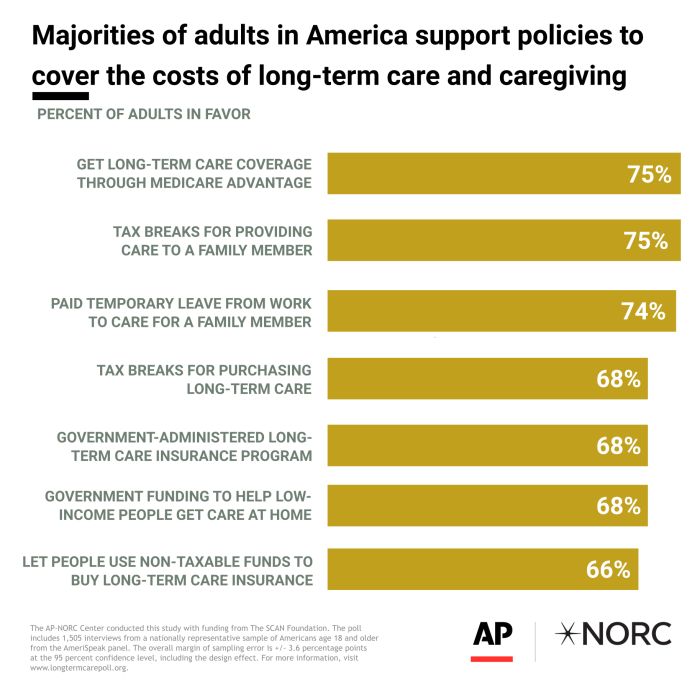

Visualizing Support for Greater Government Role in Health Care for, Consultancy firm kpmg anticipates changes in the upcoming union budget, including doubling standard deduction to rs 1 lakh, increasing tax breaks on housing. The following are the new 2025 deductible limits per.

Long Term Care Insurance Deduction Self Employed In Powerpoint And, The following are the new 2025 deductible limits per. Under germany’s new budget plan, several changes will be made to the tax system in 2025.

You Ask, We Answer Deductions for the Federal Long Term Care Plan, Long term care insurance premiums are deductible on your taxes. This allows for the deduction of either the actual premium or the eligible premium paid on a tax.

Criteria for Federal and New York State Tax Deduction for Long, The 2025 maximum deductible limit for that age band is $5,960. Under germany’s new budget plan, several changes will be made to the tax system in 2025.

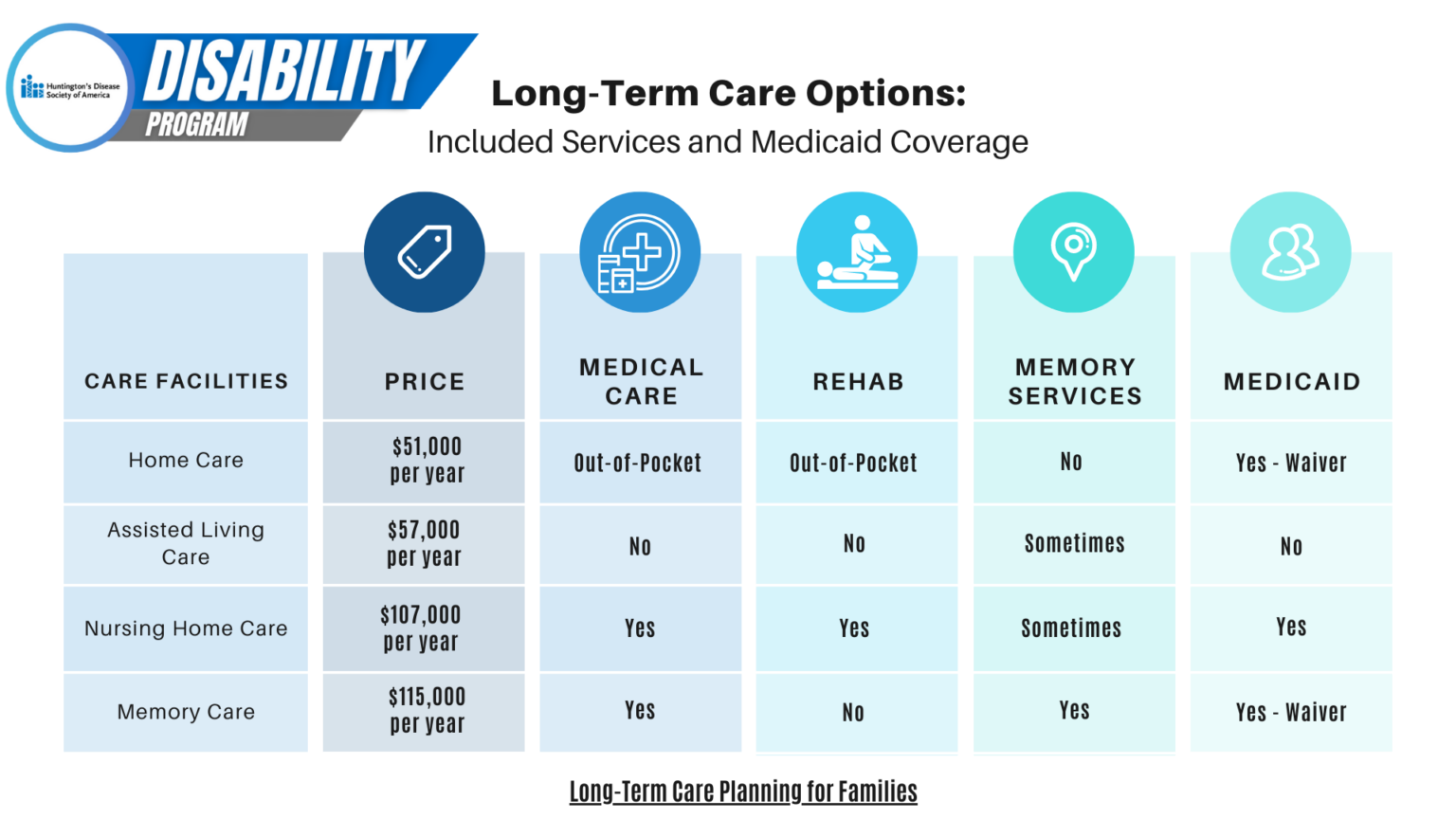

Understanding Longterm Care Planning and HD Huntington's Disease, In 2025, the irs lowered the hsa contribution limits from their 2025 limits. Short term capital gains (covered u/s 111a ) 15%.

LongTerm Care Annuity Definition, Pros, Cons, & Alternatives, This limit is determined by your age, income and more. The just announced 2025 limits for an individual age 70 or more is $5,880, according to aaltci.

Traditional LongTerm Care Insurance Tax Deductions YouTube, Short term capital gains (covered u/s 111a ) 15%. Long term care insurance premiums are deductible on your taxes.

Longterm care planning considerations Fidelity, The following are the new 2025 deductible limits per. This allows for the deduction of either the actual premium or the eligible premium paid on a tax.

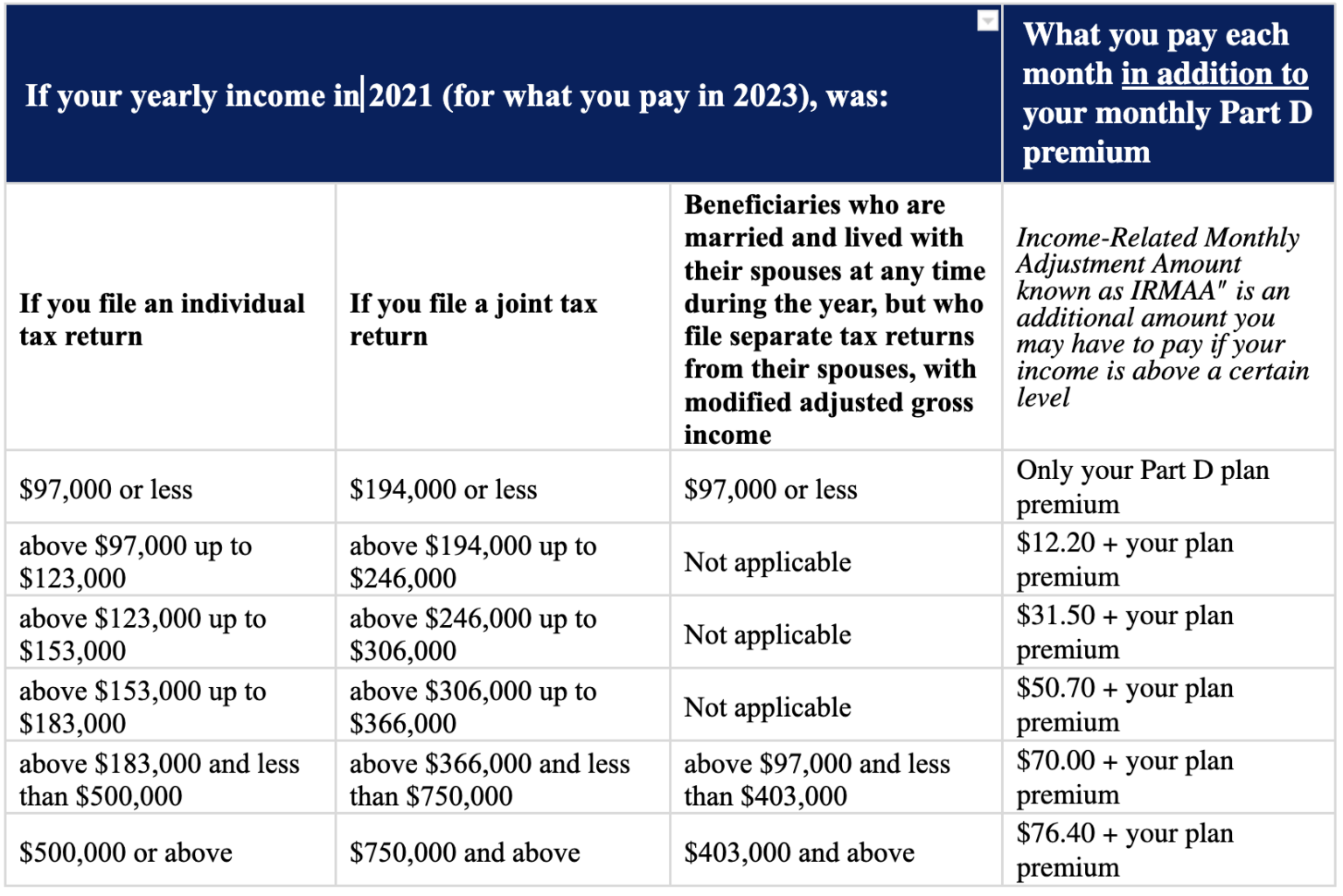

Medicare Premium, Deductible, CostSharing and Other Changes for 2025, Short term capital gains (covered u/s 111a ) 15%. Tax deductible limits for 2025 will increase between 6 and 7 percent slome notes.

In 2025, lawmakers have a window for significant tax reform as key provisions from the tax cuts and jobs act (tcja) are set to expire.